victims for over 25 years.

What is Collision Insurance?

I spend a lot of time in my articles talking about why you need Underinsured Motorist Coverage (UIM), but I also get asked about the many other types of auto and motorcycle insurance policies that you should have. And no wonder: insurance is a very confusing industry. Not only does each state have different laws guiding what kind of insurance you must carry, as well as the minimums required, but each insurance company offers these items differently.

I often get asked the following questions:

- What is collision insurance?

- What is comprehensive insurance?

- What is liability insurance?

- What is the minimum auto insurance required in Colorado?

- Why do I need underinsured motorist coverage if I have collision insurance?

Let’s get into the weeds so that you can fully understand the different types of auto and motorcycle insurance.

In this article, I’m going to break down each of those questions to help you better understand what you need to have legally in the state of Colorado and what you should have to protect yourself properly. (As I’ve said in the past, there is no magical pot of money when you get hurt in an accident. If the other driver isn’t insured properly, you need to have enough insurance to cover your own expenses.)

Questions to Ask Yourself When Buying Auto or Motorcycle Insurance

While there are legal requirements guiding what kinds and amounts of auto and motorcycle insurance you purchase, you need to also think about your personal needs beyond the bare minimum. Here are a few suggestions for you to consider from the National Association of Insurance Commissioners.

While there are legal requirements guiding what kinds and amounts of auto and motorcycle insurance you purchase, you need to also think about your personal needs beyond the bare minimum. Here are a few suggestions for you to consider from the National Association of Insurance Commissioners.

Your policy should:

- Provide at least the minimum coverage that your state’s laws require. (I’ve included Colorado’s mandates later in this article.)

- Provide enough liability coverage to pay someone else for their property damage, medical care and other costs that you may cause.

- Provide you with enough coverage to pay for your own property damage (collision insurance), medical care (medical payments coverage) and other costs (UIM) if you are in an accident.

- Provide coverage for all members of your household, including students away at school or other adults who live with you.

Does your current policy adequately address all of these areas? If you’re not sure, call your insurance agent for a policy review.

Now, let’s get into the weeds so that you can fully understand the different types of auto and motorcycle insurance. (You might keep this article handy and use it as a checklist when you’re talking to your insurance agent!)

What is Collision Insurance?

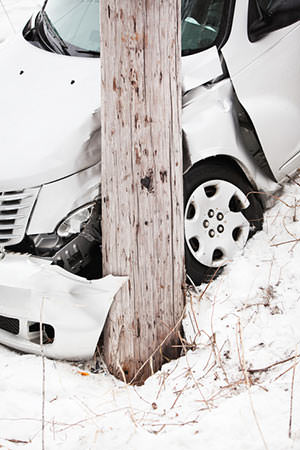

Collision car insurance protects your car when it is involved in a crash with another vehicle or a stationary object. Most car crashes and auto accidents fall under this kind of insurance policy. The types of damages include crashing into another vehicle, another vehicle colliding with yours, or ramming into a streetlight, pole, or some other stationary object. It’ll cover the cost of repairs or replacements to your own car (liability coverage takes care of damages to other people’s property). However, this coverage will not pay for any medical bills you incur.

Collision car insurance protects your car when it is involved in a crash with another vehicle or a stationary object. Most car crashes and auto accidents fall under this kind of insurance policy. The types of damages include crashing into another vehicle, another vehicle colliding with yours, or ramming into a streetlight, pole, or some other stationary object. It’ll cover the cost of repairs or replacements to your own car (liability coverage takes care of damages to other people’s property). However, this coverage will not pay for any medical bills you incur.

In Colorado, collision coverage is not required by law, though your bank may require it if you have an auto loan.

What is Comprehensive Insurance?

Comprehensive car insurance doesn’t give you complete coverage, contrary to what its name might indicate. Comprehensive car insurance just covers damages to your vehicle not caused by a collision, and car owners can be surprised by how much this can encompass. Comprehensive coverage generally falls under “acts of God or nature”, that are typically out of your control when driving – a spooked deer, a heavy hailstorm, a carjacking, etc.

In Colorado, comprehensive auto insurance is optional coverage, though your bank may require it if you have an auto loan.

In Colorado, the hit-and-run statistics look like an epidemic.

What is Liability Insurance?

Liability car insurance covers damages to another person resulting from an accident that you cause. If you cause an accident, liability coverage will help you pay for damage to another person’s property or for costs associated with their injuries. (Your liability coverage doesn’t pay for any of YOUR expenses related to any accident ever. It pays for damage and injuries that you cause.)

There are two types of liability coverage:

- Bodily injury liability (BI) covers you if you cause an accident in which someone else is hurt or killed. Colorado requires limits of $25,000 per person for bodily injury, $50,000 per accident for bodily injury—commonly expressed as “25/50” on your insurance card. However, many financial experts recommend carrying at least $100,000 per person and $300,000 per occurrence – commonly expressed as “100/300.”

- Property damage liability (PD) covers you when you damage someone else’s property. Usually it’s someone else’s car, but it could apply to buildings, utility poles, garage doors, and other physical property. Colorado requires a limit of $15,000 per occurrence.

What is Medical Payments Coverage?

Medical payments coverage (Med Pay, or MPC) covers first responders, emergency room bills, co-pays, deductibles, doctor visits, chiropractors, massage therapy, physical therapy… in essence, it may cover a lot of things that your health insurance doesn’t. And if you die, your family can use it to pay off the bills that may have stacked up in the medical efforts that failed to save your life.

Medical payments coverage (Med Pay, or MPC) covers first responders, emergency room bills, co-pays, deductibles, doctor visits, chiropractors, massage therapy, physical therapy… in essence, it may cover a lot of things that your health insurance doesn’t. And if you die, your family can use it to pay off the bills that may have stacked up in the medical efforts that failed to save your life.

Colorado insurers are required to offer you $5,000 in MedPay coverage. You must opt out or the coverage and premium will automatically be added—whether you’re buying a new policy or renewing one.

Read more about the benefits of Med Pay.

If I Buy all of the Insurance Required by Colorado Law, Why Do I Need Underinsured Motorist Coverage?

You should always (always, always) have Underinsured Motorist Coverage (UIM) on every car that you own. UIM kicks in when you’re the victim in a car accident and the other driver doesn’t have enough coverage to pay for your bills. As I’ve said, in Colorado where the hit-and-run statistics look like an epidemic, you need UIM more than ever. I recommend a minimum of $250,000 of UIM because it covers medical deductibles, medical bills, medical co-pays, pain and suffering, lost wages and other economic losses.

This is typically the “pot” from which those huge settlements that you see on TV come from. If you don’t have UIM, and the other driver only has $25,000 (the minimum required by the law), you will only get $25,000, which probably won’t even come close to covering your expenses.

In Colorado, insurers are required to offer UM/UIM in the same amount as the bodily injury liability limits you select. UM/UIM can be waived only if it’s rejected in writing. Don’t waive it; buy as much as you can afford!

Handy Chart Showing Average Insurance Premiums in Colorado

I know from my own personal shopping experience that selecting an insurance carrier can be frustrating and confusing. I’m happy to chat with you about the coverage you currently carry and what you might want to add.

Additionally, the state of Colorado hosts a handy, interactive tool that helps you to compare your auto insurance costs to averages across the state. While it doesn’t tell you exactly what you should be paying, it can help you to understand if your premiums are high or low compared to others like you. This can be a nice bit of information when you’re shopping around.

And, as usual, please call me with any questions – (303) 388-5304!

Related articles:

What Should You Do if You or a Loved One Has Been Injured in a Motorcycle Accident – Don’t get victimized by illegal billing practices.

Worst Car Insurance Companies – They should be on your side but our years of dealing with insurance company proves they are out to pay you as little as possible, even if the accident wasn’t your fault.

Free Consultation

Search For

Recent Articles

- Pedestrian Injured in Traffic Incident Near Hampden

- Careless Driving Leads to Serious Injury in Denver’s Speer Neighborhood

- Careless Driving Leads to Serious Injury in Montclair Incident

- Bicycle and Car Collision at Colfax and Emerson in Denver

- Early Morning Collision in Capitol Hill Leaves One Seriously Injured

Categories

- Arvada

- Aurora

- Auto Accident eBook

- Auto Insurance

- Bicycle

- Bicycle/Motorcycle Accidents

- Bodily injury

- Car accidents

- Centennial

- Colorado

- Colorado Legislature

- community

- Denver

- Denver Metro Motor Vehicle Accidents

- distracted driving

- DUI Accidents

- Englewood

- Events

- Flood Insurance

- Fort Collins

- Highlands Ranch

- Hit and Run

- In The News

- insurance companies

- Lakewood

- Littleton

- Marijuana DUI

- Motorcycle Accidents

- Motorcycle Insurance

- Motorcycle Law eBook

- Motorcycles

- Newsletter

- Pedestrian

- Personal Injury Law

- Press Release

- Safe Driving

- Safety

- Scooters

- technology

- Tips

- Uncategorized

- vibrio vulnificus bacteria

- Videos

- Westminster

- Winter Driving

- Wrongful Death

Archive

- July 2025

- June 2025

- May 2025

- April 2025

- March 2025

- February 2025

- January 2025

- December 2024

- November 2024

- October 2024

- September 2024

- August 2024

- July 2024

- May 2024

- April 2024

- March 2024

- February 2024

- January 2024

- December 2023

- November 2023

- October 2023

- September 2023

- August 2023

- July 2023

- June 2023

- May 2023

- April 2023

- March 2023

- February 2023

- January 2023

- November 2022

- September 2022

- April 2022

- March 2022

- February 2022

- January 2022

- December 2021

- November 2021

- October 2021

- September 2021

- August 2021

- July 2021

- June 2021

- May 2021

- April 2021

- January 2021

- December 2020

- November 2020

- October 2020

- September 2020

- August 2020

- July 2020

- June 2020

- May 2020

- April 2020

- March 2020

- February 2020

- January 2020

- December 2019

- November 2019

- October 2019

- September 2019

- August 2019

- July 2019

- June 2019

- May 2019

- March 2019

- February 2019

- January 2019

- December 2018

- November 2018

- October 2018

- September 2018

- August 2018

- July 2018

- June 2018

- May 2018

- April 2018

- March 2018

- February 2018

- January 2018

- December 2017

- November 2017

- October 2017

- September 2017

- August 2017

- July 2017

- June 2017

- May 2017

- April 2017

- March 2017

- February 2017

- January 2017

- December 2016

- November 2016

- October 2016

- September 2016

- August 2016

- July 2016

- June 2016

- May 2016

- April 2016

- March 2016

- February 2016

- January 2016

- December 2015

- November 2015

- October 2015

- September 2015

- August 2015

- July 2015

- June 2015

- May 2015

- April 2015

- February 2015

- November 2014

- October 2014

- September 2014

- July 2014

- June 2014

- May 2014

- April 2014

- March 2014

- February 2014

- January 2014

- October 2012

- September 2012

- August 2012

- July 2012

- February 2012

- March 2011

- October 2010